- February 28, 2024

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

What’s in your pipeline? Are the opportunities made of gold bullions or lumps of coal? Or both?

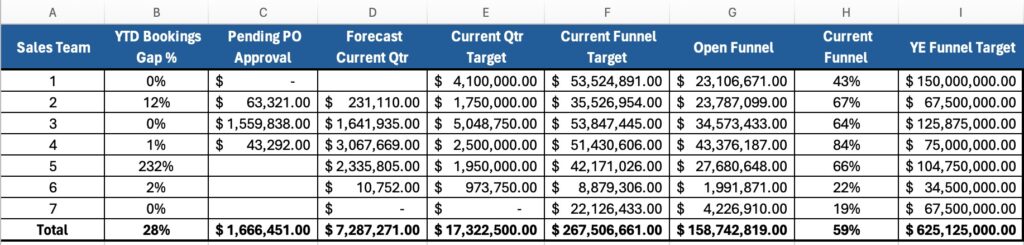

This week, my team had two reactions to a client’s pipeline report. We looked at the sheer amount of data and said, “Wow, that’s a lot of information!” Then we looked beyond the data and said, “This won’t work because it’s the wrong data.” When there are multiple reactions, the final impression is only as strong as the worst reaction so the data in this pipeline report gets a strong No.

I recreated their data in the table below and eliminated all of the identifiable information as well as unnecessary data. What remains is a very small percentage of what we received and reviewed.

Some observations:

- The data represents the forecast and funnel for 7 sales teams.

- The gaps (B & G) are backwards and should say 72% (A) and 41% (G).

- The quarterly forecast (D) is at 42% of the quarterly target (E).

- The current closable opportunities (C) are at 23% of the forecast (D) and at less than 10% of the quarterly target (E).

- Columns B, C, D, E, G and H represent pathetic, old news.

The question that should be asked is, “What can we do about this?”

We should be able to answer that question by looking at column F but that’s not possible. Can you see why?

Outside of telling us that there isn’t enough in the funnel, the data in column F doesn’t answer the question that must always be asked: Is the pipeline viable?

We know the assigned value of the pipeline but we don’t know the answers to these additional ten important factors:

- Where did the assigned value come from? Early stage opportunities should not have an assigned value. If salespeople simply slapped a number on early stage opportunities and the number came out of their asses, what does that do to the integrity of the values of the pipeline and forecast?

- How many opportunities do the assigned values represent by team and by salesperson? If these are very large opportunities, there are fewer of them and a single loss or dead opportunity significantly decreases the value of the pipeline.

- In which stage of the pipeline do each of those opportunities legitimately belong (objective, not subjective) by team and by salesperson? If the opportunities were staged by salespeople with happy ears, the opportunity probably belongs in a much earlier stage of the pipeline.

- How long have those opportunities been in their current stage by team and by salesperson? If the time in stage is excessive, there is a good chance the opportunity is dead. Of greater concern, why has the opportunity been allowed to stagnate? Was the salesperson afraid to ask the customer? Was the salesperson afraid to remove the opportunity from the pipeline because the gap to target would increase? Was the sales manager afraid to question the salesperson? Was the sales manager afraid to remove it because the gap to target would increase?

- Who the salespeople are talking with. Are they decision makers or are they simply contacts? We know that the business is 341% more likely to close if the salespeople are talking with decision makers, so this is an important distinction!

- Who we are competing against. Companies usually have competitors against whom they match up more or less favorably. What does it mean if the company is going up against competitors who usually beat them?

- The Score. The company should have a custom scorecard that awards points based on the conditions and criteria that would suggest whether or not an opportunity can be won. No score? We are driving with blinders on.

- Which salesperson is assigned to the opportunity. Some salespeople are much stronger and more reliable than others. Our chances of winning an opportunity may be directly related to the salesperson.

- If the funding has been approved. We had already seen opportunities that had somehow reached the proposal milestone despite the absence of funding! What would that do to the assigned value, stage and likelihood of closing?

- The customer’s timeline. This funnel is self-centered as it is all about our client. But we don’t know if the salesperson’s timeline is aligned with the customer’s timeline.

Most salespeople suck at qualifying and that might be the case here. But most CRM applications are woefully inadequate at capturing and reporting useful information in a format that sales leaders can use to coach and create accurate forecasts. An exception to all of the CRM challenges is Membrain and their Baseline Selling Edition perfectly combines world-class CRM with the Baseline Selling process and methodology.

You might get the sense that pipeline staging and qualifying are the challenges here but they are merely symptoms of greater issues. Recruiting and selection as well as sales coaching are the bigger issues that cause pipeline and qualifying to be the focus of this article.

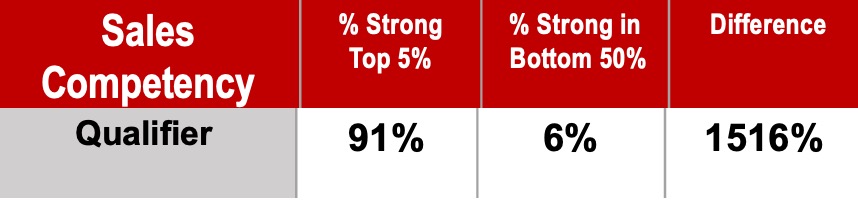

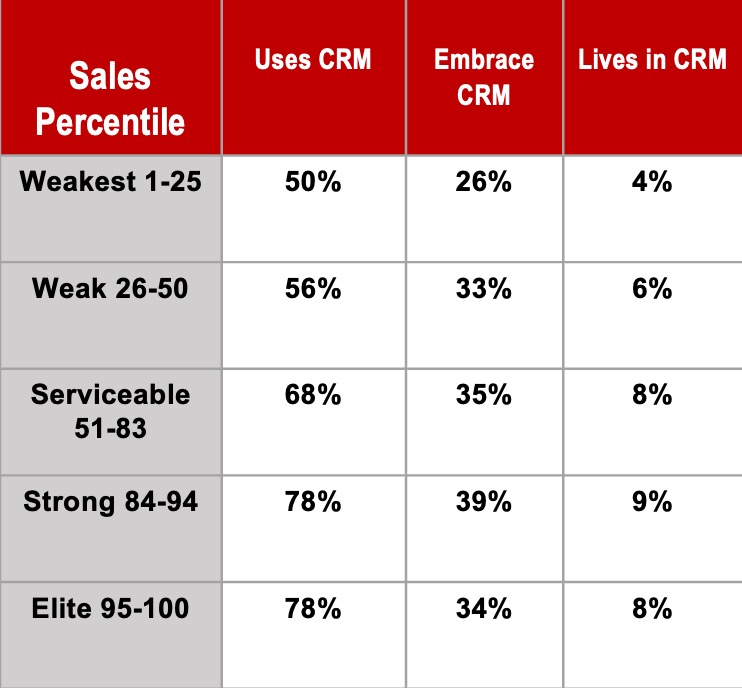

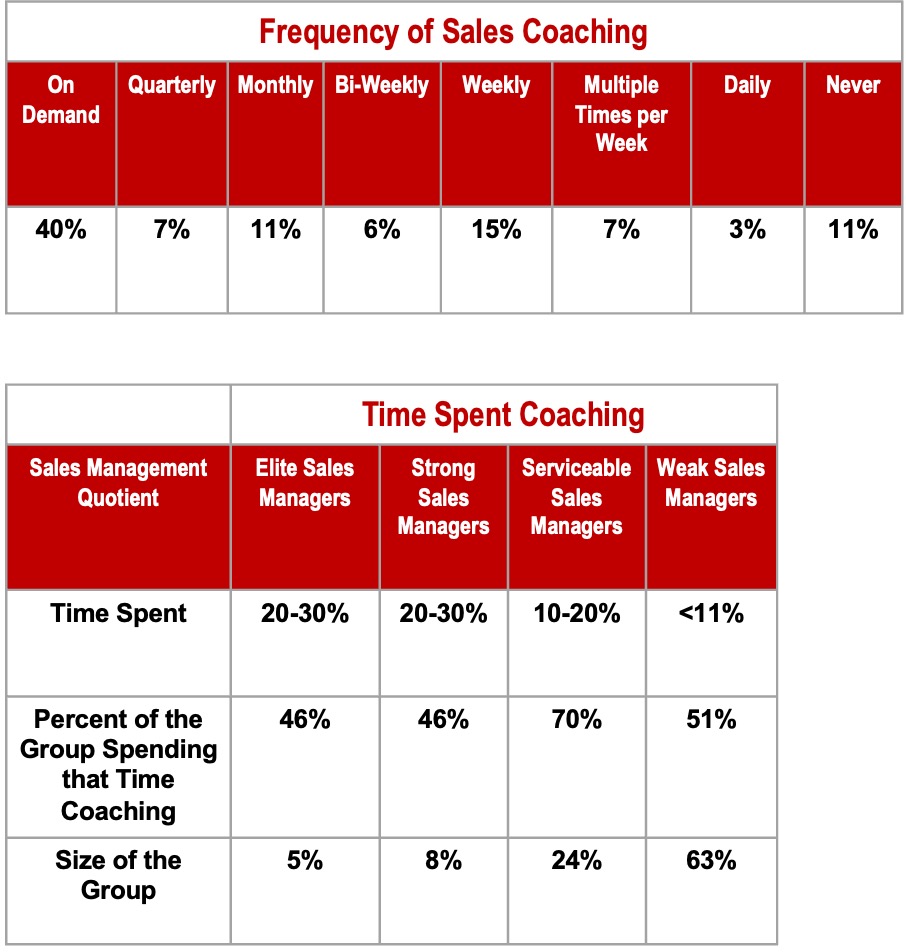

Here is some additional data on 2 of the 21 Sales Core Competencies – Qualifier and CRM Mastery – as well as 1 of the 20 Sales Management Core Competencies – Coaching.